Collections Insurance Guide: Everything you need to know

Read blog post

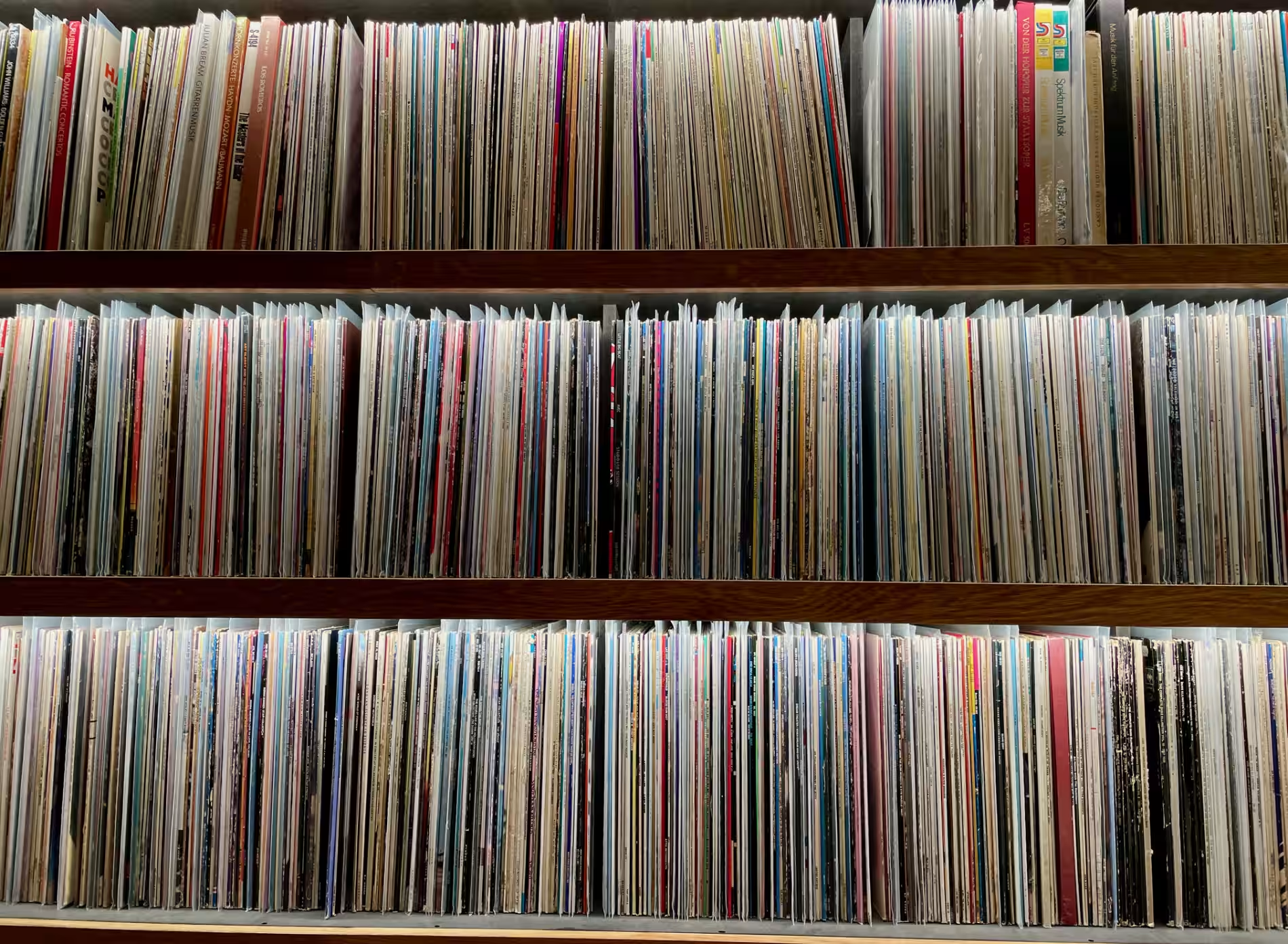

Our comprehensive range of collection insurance policies gives you the peace of mind to custom build your collection how you want.

Find out more

Our comprehensive range of wine insurance policies gives you the peace of mind to custom build your collection how you want.

Find out more

From a violin to trombone, DJ equipment or a piano, we provide you with insurance when your instrument is accidentally damaged, lost or stolen.

Find out more