The content provided does not consider your particular circumstances and does not constitute personal advice, please check with your policy or insurer for accurate terms and conditions.

In this guide

Collections insurance covers high-value collections of all types, allowing you to continue cultivating your collections while we focus on protecting them. Whether you have a passion for art, wines, antiques and more, or you simply invest your money into these physical collections, we can cover them so even if they are damaged, stolen or lost, you won’t have to panic. We’re here to help you understand what collectors’ insurance does, how it can help you, and the collections we cover.

What is collections insurance?

Collections insurance is a policy which protects your collection in the event of theft or damage.

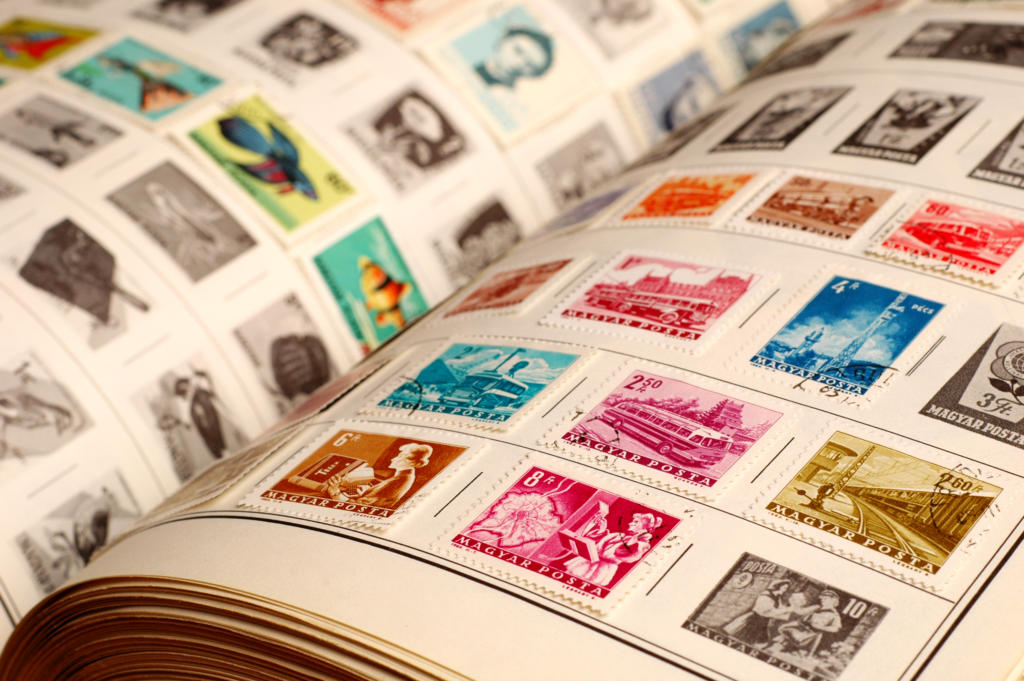

When talking about collections, we’re referring to valuable collections with the home that are not general contents or luxury watches or jewellery. Collections, therefore, include but are not limited to, Fine Art and Paintings, Stamps, Antique Furniture, Books, Memorabilia, Wine and Whiskey, Musical Instruments, or other General collections which hold a slightly higher value than general contents.

Please note that throughout the article, we use the words ‘valuable’ and ‘collection’ interchangeably. This reflects policy wordings, which tend to do likewise.

We understand how painstaking it can be cultivating your very own collection, filled with collectables that are likely worth a fortune, both literally and sentimentally.

Collections can be any range of goods that is usually valuable sentimentally and monetarily. They often take a huge amount of investment to start and continue to collect these treasures, and you’re no doubt frightened at the thought of them being stolen or damaged. Collections insurance helps to ease the pain if that becomes your reality.

Types of collections you should consider insuring

There is a wide range of collections you could have, but here are the ones you should consider insuring:

- Antique collections

- Art collections

- Book collections

- General collections

- Musical instrument collections

- Stamp insurance

- Wine insurance

These encompass nearly all facets of valuable collections. Having high-quality insurance for your collections helps ensure that future generations can continue to cultivate and care for them and removes the worry of damage or theft.

How does collectors’ insurance work?

Your collection will likely be one of your prized possessions, whether it was bought out of passion or as an investment. We offer two distinct options – a standalone bespoke policy or inclusion within our High Value Home Insurance policies.

We understand collections can take years to build, so with Stanhope, you don’t need to go through the process of itemising your collection if you choose to go down the high-value home insurance route. If you insure the collections on a stand-alone product, we may require some form of inventory, but the good news is, we have the authority to bind up to £1mil of cover in-house – turning an enquiry into a live policy with exceptional efficiency.

Does my home insurance cover my collectables?

Standard Home Products

Within a standard home insurance policy wording, collections, as listed above, are usually defined as valuables. Because of this, inner limits and restrictions can be placed on the level of cover included as standard. For example, on the Aviva Your House policy, you are only covered up to the individual and total limits shown on your schedule. This is usually up to £5,000 for one item and up to £30,000 as a total valuables limit. You can add and remove valuables as required so long as they fit within the policy limits.

High-Value Home Products

High Value Home Insurance products work differently, they are more like tailor made suits that are cut-to-fit. On a high-value home product, the prospect advises the insurer of the level of coverage they require for valuables. The insurer underwrites the risk on a case-by-case cover and offers or declines based on the total sums insured required. There is no upper limit on total valuables, but there is usually a specified limit of £50,000 for any single item.

Stand Alone Products

If you decide to insure the item on its own, separately from your home contents insurance, then you need to specify each and every item you require coverage for, regardless of value. If the item is not specified on the schedule, you’re not covered. There is no upper limit on what can be covered, so long as it’s written onto the schedule.

General Cover Points Regardless of Product

Each product will cover collections in the home as standard (as most collections are kept in the house only), but a high-value home product will also cover the items away from the home. Each product will cover you against the standard perils (flood, subsidence, escape of water, etc) and will also extend to include accidental damage, loss, fire, theft and attempted theft. In short, your collections will benefit from the same cover as your general contents.

Get a quote now

What is included in the collectors’ insurance?

Standalone collections insurance features some key benefits:

- Worldwide all risks cover

- No excess to pay

- Agreed-value cover

- New for old cover

- Physical loss and damage cover

We provide bespoke standalone cover for your collections so you can receive high-quality insurance for your collection at a reasonable price up to an agreed value for loss, damage, and much more. The fact that our collectors’ insurance can be purchased even if you don’t have home contents insurance with us allows you to protect your valuable collections with ease. You can focus on building your collection while we keep it protected for you.

Collectable physical damage cover

Theft and loss

Collections cover protects you if your collectables are lost or stolen so even if tragedy happens you’ll have peace of mind that it will be made whole again.

Fire and smoke

If covered under your home insurance, your collectables will be protected against fire and smoke damage as long as they are under the pre-agreed value limit within your home contents insurance or you’ve added bespoke cover for the more expensive items through your provider.

New acquisitions

You will usually be covered for new acquisitions, up to 10% of the sum insured for new items you have bought but which you have not told us about within 14 days of purchase.

Replacement of security

All products will offer to replace or repair any locks, keys or safes in the event of a theft or attempted theft claim.

Pairs and sets

We will cover if any items that have an increased value because they form part of a Pair or Set are lost or Damaged. Any payment we make will take account of the increased value.

Depreciation

If the insurer repairs a damaged item, they will typically pay for any loss in value. The most they will pay is the amount Insured for that item.

Defective title

If someone claims that an item is not rightfully yours, and you are legally obliged to return the item to its rightful owner (because it is proved that you don’t have good title to it), an insurer will pay the amount paid for it, or the value shown in the specification if this is less. This protects you if you’ve purchased a fake item or a stolen item.

Types of collections insurance cover

As seen above, you can cover your collections in one of three ways:

- Within a Standard Home Product: the limits are set by the insurer (fit or no fit products)

- Within a High Value Home Product: you set the limits required (tailor-made products)

- On a specialist Stand Alone Product: you must specify each item on the schedule to be covered

You must look out for the basis of settlement definition within the policy you decide to purchase. The basis of settlement is the insurer outlining how they will compensate you should the item insured be damaged. The three most common basis of settlement definitions are:

- Voucher Settlement: some lower-cost budget products will settle a claim by offering you high street vouchers should an item be damaged or stolen. We wouldn’t recommend such a product as your ability to replace an item is restricted

- Agreed Value Settlement: Higher-value home and stand-alone products can offer an agreed-value settlement, IE we agree to pay an exact amount should the item be lost, stolen, or damaged. This settlement is usually only offered if you can provide an approved valuation for the item(s) at inception. This settlement basis offers the reassurance of an agreed value should the worst happen.

- Market Value Settlement: This type of settlement agrees to settle a claim based on the value of the item the day before loss, up to the amount shown on the schedule. Collections can fluctuate in value depending on market conditions, death of a designer or artist plus others.

Stanley Gibbons Guide: for a stamp collection, an insurer will usually agree up to 67% of the Stanley Gibbons Stamp value guide.

Each insurer will offer something nuanced, depending on the type of item you’re looking to cover. Ensure to speak to your broker or consult your policy wording for more information.

Does my collection need collectors’ insurance?

Insuring your collection might not be the perfect option for everyone and some may already have it insured by their home insurance without realising. But if you have a high value collection or specific collectable items, it can be best to make sure it is covered.

Monetary loss

We understand that your collection may hold a large monetary value; insurance works to reimburse you for the cash value of your collection. It is possible you’ve put a lot of capital into your collections and if that is lost you could be left in an uncomfortable situation. It could potentially even ruin future plans, like utilising the collection as a nest egg for your children or an investment to help you build on your personal wealth. Whatever the reason is, Stanhope will cover your collection for its cash value.

Protect your collection from physical damage

Collections can feature delicate items like paintings, timeless clothing pieces, or glass wine bottles, and the fragility is likely a factor why you’re collecting them in the first place. We’ve got you covered if they are damaged or tarnished so you can replace them and keep your collection whole.

Emotional attachment

Although we can’t actually remove all your stress if your collection is lost or stolen – even if we wish we could, our cover helps to ease the loss. When you’re covered by us, you’ll know we’ll be there to help you replace it.

Why choose Stanhope for collections insurance?

Stanhope’s collections insurance is bespoke and can also be an additional extra within your high value home insurance. We offer specific covers for a range of popular and more niche collections so your cover meets the specific needs of your collection, whatever they might be, we also provide our cover at reasonable prices so you don’t have to break the bank but can still experience high quality cover. All policies will have terms, conditions and limitations which Stanhope would go through before any policy was purchased.