What is vinyl record insurance?

Our vinyl insurance protects your vinyl records should they be accidentally lost, damaged or stolen. Vinyl records are not only a collector’s item but are also used by DJs, making them extremely valuable in order to perform their job. Our comprehensive collections insurance gives you peace of mind to display your records wherever you want and transport them to your next destination.

Why do you need to insure vinyl records?

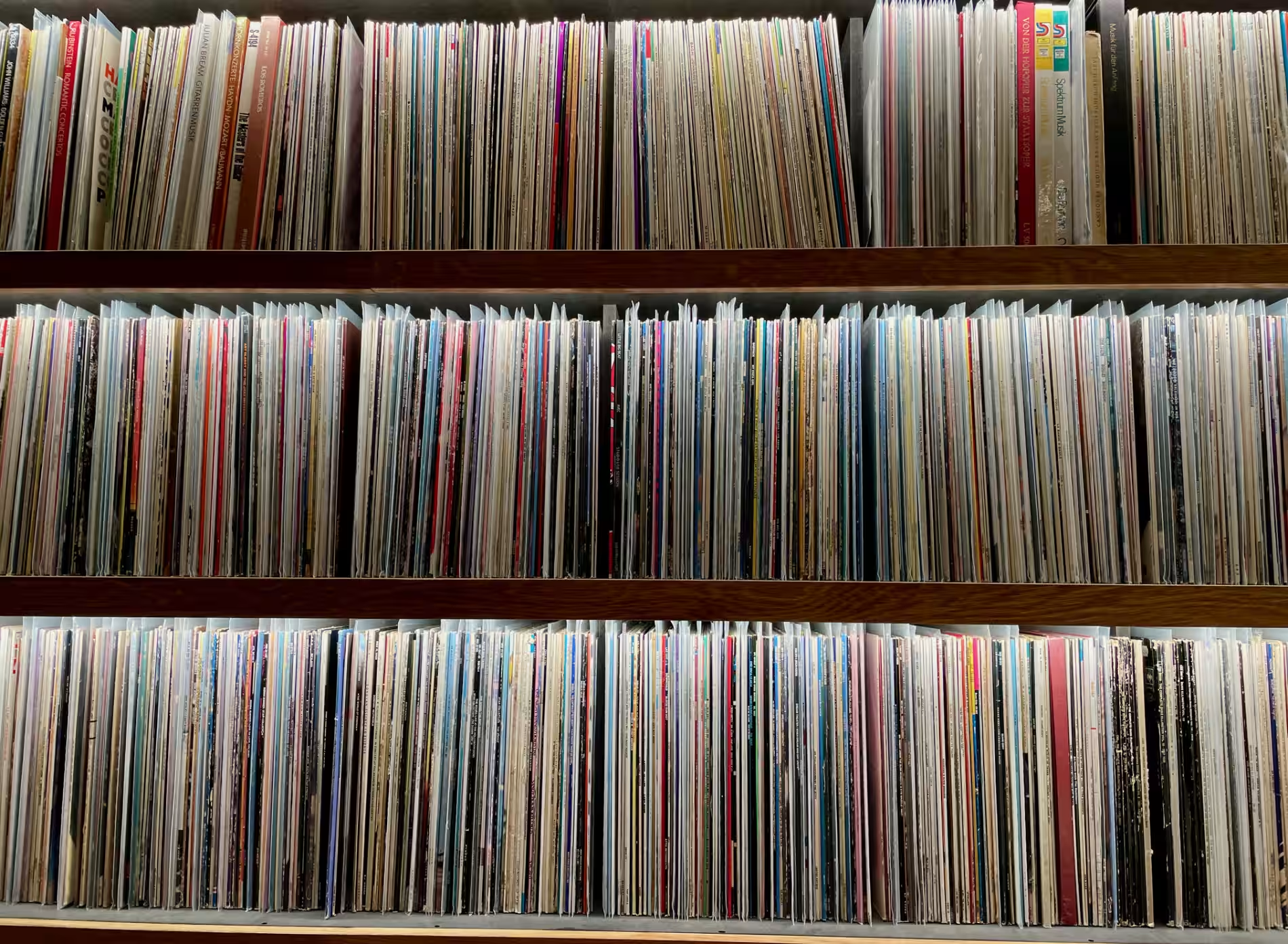

Vinyl records can easily be damaged. Many high-value record collections include vintage vinyl, which is more fragile than newer presses, meaning that extra care needs to be taken when displaying or transporting them.

Vinyl collections can also be very large, amounting to thousands of pounds in value, making them a target for criminals especially if they are left on display.

Main benefits of a vinyl record insurance policy

- No excess to pay.

- Single specified records or entire collections can be covered.

- Accidental damage is included as standard, giving you peace of mind.

- Theft cover and water damage cover included.

- Stand-alone cover up to £250,000 available.

- Agreed value with approved valuations.

In order to obtain stand-alone vinyl insurance, it’s important you have a full inventory of items as this will need to be submitted within 28 days of policy inception.

How does vinyl insurance work?

Like all insurance policies, determining the value of your single vinyl record or collection is the first step to figuring out which policy you need. Rare and limited-edition records will be worth more and the condition that these are in can impact which policy you need.

It can be effective to get a professional valuation and have your collection re-valued every few years, as like all collectibles, vinyl records constantly fluctuate in value.